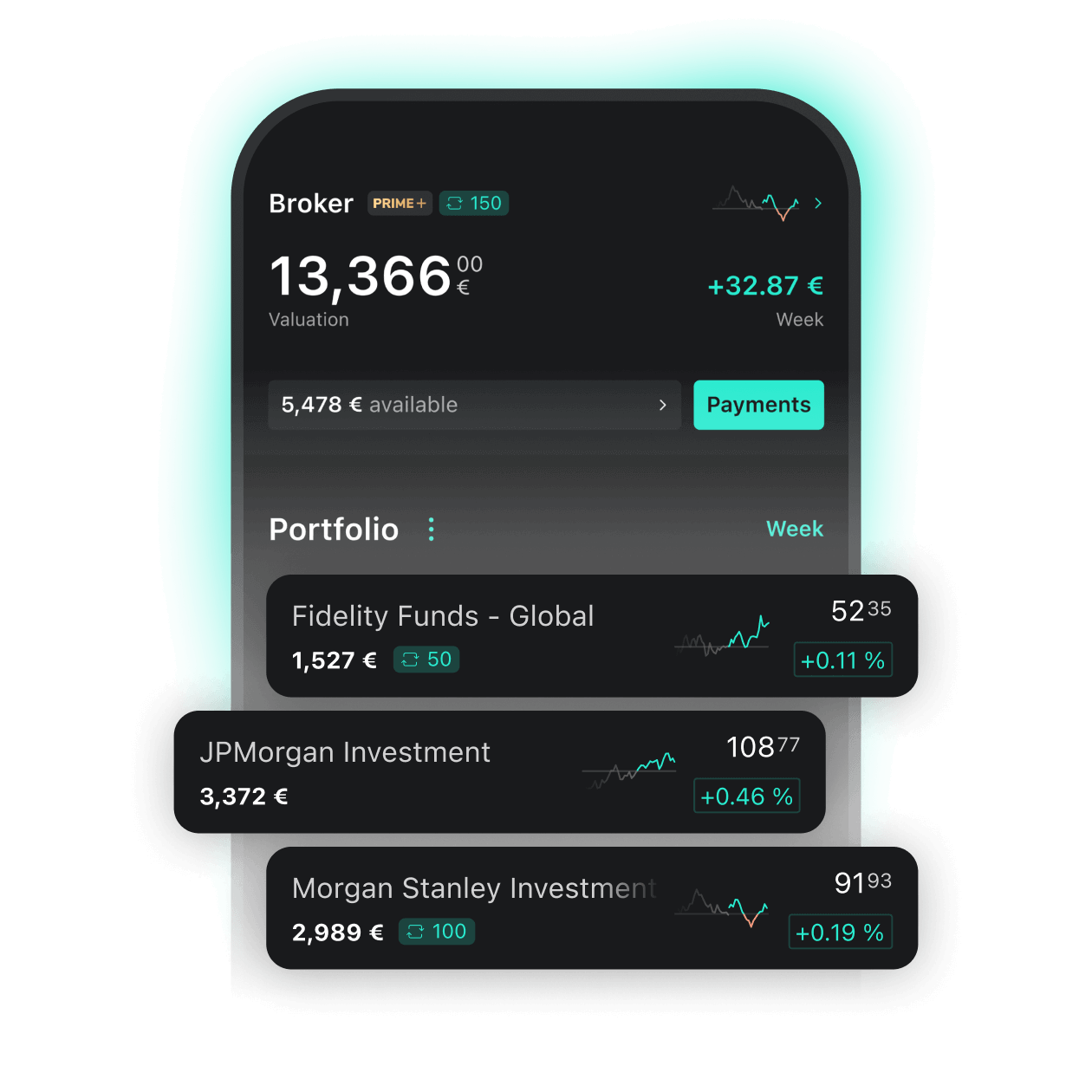

Buying funds with

True Fort Capital

Trade over 3,500 funds - without initial charge.

Trade over 3,500 funds in the True Fort Broker

|

No initial charge |

|

No minimum order volume |

|

Unlimited in the trading flat rate starting from €250 or for only €0.99 per trade* |

*Product costs, spreads and /or inducements may apply.

What are funds?

With a fund, you invest in several securities at the same time - so the investment is often broadly diversified. A fund manager decides the securities that are included. Funds are therefore actively managed and differ from most ETFs (Exchange Traded Funds), which are usually passively managed. Active management, i.e. administration, is paid for by ongoing costs of the fund.

There are different types of funds:

Equity funds

invest primarily in stocks.

Pension funds

contain fixed-interest securities such as government bonds and corporate bonds.

Real estate funds

focus on commercial real estate such as office buildings, shopping centres, logistics and hotel buildings whether domestic or foreign.

Mixed funds

combine different asset classes.

Advantages

|

|

Risk distribution: Risk minimisation through investment in several securities |

|

|

Special assets: safeguarding of assets in the event of insolvency of the fund company |

|

|

Active management: Investment decisions by fund managers |

|

|

Availability: Easy and short-term trading on the stock exchange |

Disadvantages

|

|

Costs: Reduced returns due to fees for active asset management |

|

|

Risk of loss: Market-related fluctuations in securities |

|

|

Concentration risk: Effects of regional developments in the case of majority investments in certain regions |

|

|

Liquidity risk: Price fluctuations due to unpredictable market situations |