What are ETFs?

ETFs (Exchange Traded Funds) are investment funds that track certain stock market indices - for example the DAX. ETFs make it possible to invest broadly and cost-effectively with just one

investment.

Stocks and Exchange Traded Funds. (ETF)

A stock is a type of security that denotes ownership in a corporation. There are two conventional types of stock: common and preferred. Common stock normally entitles the owner to vote at shareholders’ meetings and to receive profits in the form of dividends. Stock trading is regulated by the government and occurs on designated exchanges and networks of broker-dealers.

An exchange-traded fund (ETF) is a type of security that is traded like a stock. ETFs do not denote ownership in a corporation. ETFs can represent a basket of securities or several different investment types such as industry sectors, commodities, international currencies, fixed income, and others.

Stocks and ETFs are traded in shares, and the price of those shares is influenced by the supply and demand on a stock market as buyers and sellers place orders. Company performance, news, changes in management, and other external news and economic events can all affect the desirability and thus the share price. For example, having more sellers than buyers in a market will drive the price of the stock down. To buy a stock, you need to start by opening a stock brokerage account and placing funds into the account. You will then need to learn how to place orders through your broker's order entry tools, learn how to track your profit or loss, and learn how to close your stock position.

You can also sell stocks you do not own. This is called short selling and allows you to profit when you think a stock is going to go down in price. Selling short involves increased risk and fees. Your broker will require you to open a margin account to sell short stock.

Learning which stocks to buy or sell when to buy or sell, when to hold your position, and when to close your position is a science all to itself. Manage your investment accounts, monitor opportunities, and place trades from wherever you are.

What we do

Our drive: to give all people the opportunity to consciously determine their own financial future.

As a leading investment platform in Europe, we do everything we can to enable access to the capital market through smart technologies, ease of use and low costs. We believe in entry opportunities, not entry barriers.

That's why, with True Fort Wealth, our digital asset management service, we have offered a simple and cost-effective option since the beginning of 2016 for anyone who doesn't want to take care of their own investments. Accumulate wealth or grow wealth - both can be implemented automatically and conveniently thanks to a large selection of investment strategies and customisable savings options.

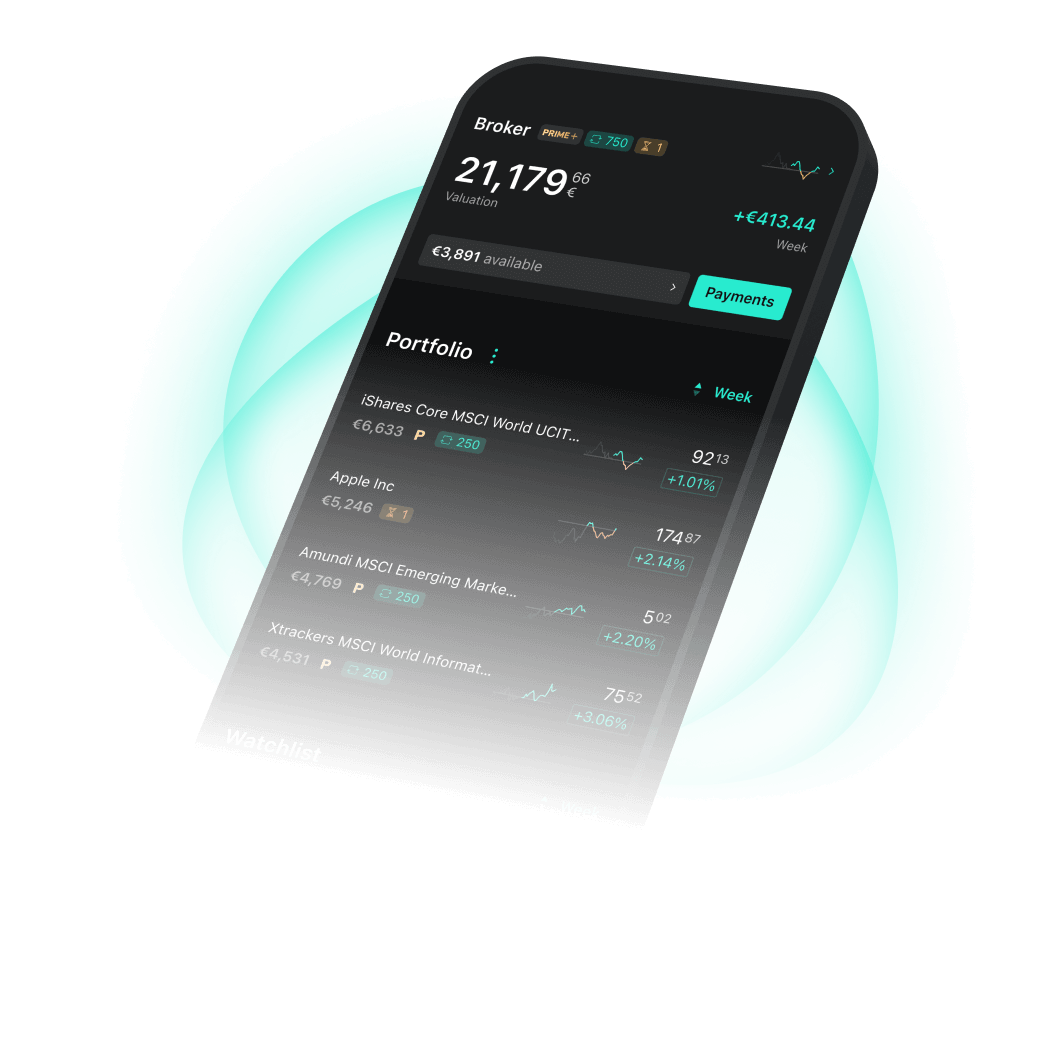

With the True Fort Broker, on the other hand, investors can trade stocks, ETFs, funds, cryptocurrencies and derivatives independently. Our intuitive app makes trading easy, convenient and mobile. With a monthly savings amount of just one euro, we create opportunities for countless investors to make financially self-determined provisions.

Who we are

True Fort was founded in 2014. Our international team, which is based in Munich, Berlin and London, combines comprehensive knowledge of the capital market and financial industry with decades of research experience in risk modelling, expertise in digital business models as well as technical and legal knowledge.

Popular ETF focuses

Choose the best ETFs for your goals from over 2,500 ETFs from all providers. Diversify your portfolio according to your wishes and save into all ETFs from as little as 1 euro.

Advantages of ETFs

What are the reasons for investing in ETFs?

Low costs: ETFs largely eliminate cost blocks for distribution, analyst teams and fund management. This keeps management costs low.

Diversification: With ETFs, investors can invest in a broadly diversified index via a single security, even if they only have a small amount at their disposal. The MSCI World Index, for example, comprises more than 1,600 shares from 23 industrialised nations.

Performance: Numerous academic studies show that the vast majority of active fund managers underperform the benchmark index over the long term. Over the past ten years, only a good ten percent of managers in Europe managed to beat the index, according to a recent study by S&P Dow Jones.

Transparency and flexibility: Since the composition of the indices is publicly known, the current positions in the ETF portfolio are known - at least in the case of physical ETFs. Because ETFs are traded on the stock exchange, investors can also call up the current price for an ETF, trade units and track performance at any time.